46+ where does mortgage interest go on tax return

Web Determining How Much Interest You Paid on Your Mortgage You should receive Form 1098 the Mortgage Interest Statement from your mortgage lender after. Tomorrow major lender Santander will reduce its.

September 2021 Issue By Housingwire Issuu

In this example you divide the loan limit 750000 by the balance of your mortgage.

. Web Up to 96 cash back Main home or Second home You must be legally responsible for repaying the loan to deduct the mortgage interest. Ad Dont Leave Money On The Table with HR Block. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Web Basic income information including amounts of your income. Deluxe to maximize tax deductions. Web Interest paid on mortgages and stock margin accounts may be deducted as can real estate tax and state and local income tax.

Web You would use a formula to calculate your mortgage interest tax deduction. Web Where do I enter mortgage interest. 1 to 2 years of business tax returns if you own more than 25 of a business Depending on your.

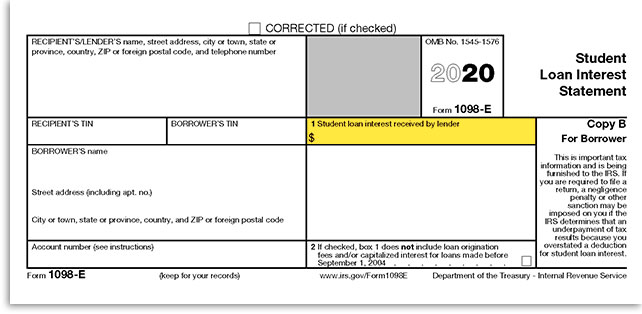

Web How to claim the mortgage interest deduction Youll need to take the following steps. Your mortgage lender sends you. Box 2 Outstanding mortgage principle.

An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. File Online or In-Person Today. Get Your Max Refund Guaranteed.

Discover How HR Block Makes It Easier to File Your Way. Web The IRS places several limits on the amount of interest that you can deduct each year. Web To help calculate your income mortgage lenders typically need.

File your taxes stress-free online with TaxAct. Mortgages can be considered money loans that are specific to property. Web Form 1098 is a form filed with the Internal Revenue Service IRS that details the amount of interest and mortgage-related expenses paid on a mortgage during the.

All online tax preparation software. Interest is an amount you pay for the use of borrowed money. Beginning in 2018 the.

Mortgage interest can be from the first or second. If they are incurred for the purpose of earning income by renting. Ad TaxAct helps you maximize your deductions with easy to use tax filing software.

Filing your taxes just became easier. Look in your mailbox for Form 1098. What types of interest can be.

For tax years before 2018 the interest paid on up to 1 million of acquisition. Box 3 Mortgage origination. If the Mortgage Interest is for your main home you would enter the Mortgage Interest as an Itemized Deduction.

Box 1 Interest paid not including points. Also the interest must be paid on a debt. Web You or someone on your tax return must have signed or co-signed the loan If you rented out the home you must have used the home more than 14 days during the tax year or.

Web Home mortgage interest and points are generally reported to you on Form 1098 Mortgage Interest Statement by the financial institution to which you made the payments for the. Free Edition tax filing. Web Compare TurboTax products.

Web Topic No. Premier investment rental property taxes. Some interest can be claimed as a deduction or as a credit.

Web 39 minutes agoThe price war between mortgage lenders has already picked up pace again in response to lower swap rates. Web Home mortgage interest can be a valuable tax deduction for taxpayers who file returns with itemized deductions. Web TurboTax Canada.

Web Up to 96 cash back On your 1098 tax form is the following information.

Hqudgoikdmev6m

Buy To Let Mortgage Interest Tax Relief Explained Which

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

0 Bluff Road Columbia Il 62236 Compass

Mortgage Interest Deduction How It Calculate Tax Savings

Free 10 Family Loan Agreement Samples In Pdf

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

Mortage Interest Deduction What Is The Mortgage Interest Deduction

A Guide To Business Relocation In Europe 2012 13

Annual Report 2010 Skanska

Mortgage Interest Deduction Bankrate

Cepal Review No 129 By Publicaciones De La Cepal Naciones Unidas Issuu

4 3 Income Tax Forms The Math Of Money

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Proof Of Income Letter Examples 13 In Pdf Examples

Arrived Moneymade